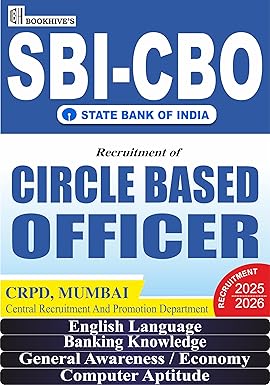

The State Bank of India (SBI), India’s largest public sector bank, conducts the Circle Based Officer (CBO) examination to recruit experienced professionals for its various circles across the country. The role of an SBI CBO is both prestigious and responsible, aimed at candidates with prior banking experience who are ready to take on managerial responsibilities. With intense competition and a rigorous selection process, a comprehensive understanding of the exam pattern, syllabus, and an effective preparation strategy is essential for aspirants aiming to secure a position in this role.

OVERVIEW OF SBI CBO RECRUITMENT

The SBI CBO recruitment process is designed to select candidates who already have banking experience and are well-versed with local language, banking operations, and regional market conditions. Unlike clerical or probationary officer exams, this exam focuses more on practical knowledge and managerial aptitude.

The CBO posts are generally non-transferable outside the selected circle, making it more localized in its approach. Candidates are selected to work in their chosen circle, which adds a level of job stability and familiarity with the regional banking dynamics.

SBI CBO EXAM PATTERN

The SBI CBO selection process is typically divided into three major stages: Online Written Test (Objective + Descriptive), Screening of Application, Interview

Online Written Test

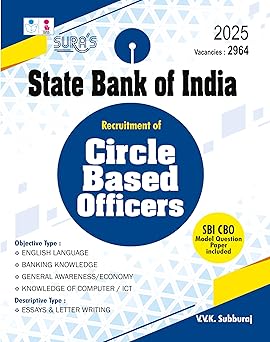

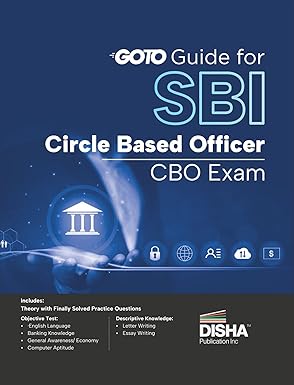

The SBI Circle Based Officer (CBO) Exam includes an Objective Test divided into four key sections, each designed to assess specific competencies relevant to banking operations. The English Language section comprises 30 questions, carrying 30 marks, with a time limit of 30 minutes.

This section tests candidates on grammar, comprehension, vocabulary, and sentence construction. The Banking Knowledge section includes 40 questions for 40 marks, with 40 minutes allotted. It evaluates the candidate’s understanding of core banking concepts, regulations, financial systems, and RBI guidelines.

The General Awareness/Economy section has 30 questions, also worth 30 marks, and candidates are given 30 minutes to complete it. It covers current affairs, economic developments, government schemes, and financial awareness.

Lastly, the Computer Aptitude section consists of 20 questions for 20 marks, with a time duration of 20 minutes, focusing on basic computer knowledge, digital banking, cybersecurity, and information technology. Overall, the test is structured to assess candidates comprehensively across language skills, domain expertise, current affairs awareness, and technical proficiency, with a total of 120 questions, 120 marks, and an overall duration of 2 hours

Descriptive Test: Total Marks: 50

- Time: 30 minutes

- Sections:

- Essay Writing (1 topic – 250 words)

- Letter Writing (1 topic – 150 words)

The descriptive paper tests the candidate’s written communication skills, clarity of thought, and knowledge on banking-related topics.

SYLLABUS FOR SBI CBO EXAM

The SBI CBO syllabus focuses on both theoretical and practical aspects of banking. Here’s a breakdown of the section-wise syllabus:

English Language

Reading Comprehension, Cloze Test, Spotting Errors, Sentence Correction, Sentence Improvement, Fill in the Blanks, Para Jumbles, Sentence Rearrangement, Sentence Based Errors, Word Rearrangement, Word Swap, Word Usage, Misspelt Words, Jumbled Words, Match the Column, One Word Substitution, Identify the Correct Sentence, Antonyms and Synonyms, Word Replacement, Phrase Replacement, Sentence Connector, Idioms and Phrases, Vocabulary, Starters, Pairs of Words

Banking Knowledge

Banking Terminologies & Abbreviations, Structure & History of Banking in India, RBI Roles & New Initiatives, Monetary Policy, Financial Markets, NBFCs, NPAs & SARFAESI Act, Basel Norms, Payments and Settlement Systems in India, KYC, Banking Technologies, ATM Types, Payment Banks, Small Finance Banks, Financial Inclusion, Negotiable Instruments, Priority Sector Lending, Banking Ombudsman, Principles of Insurance, Money and Banking, Knowledge of Financial Institutions

General Awareness / Economy

Current Affairs (National & International), Banking Awareness, Government Schemes & Policies, Financial Awareness, RBI in News, Business & Economy, Indexes & Rankings, Agreements & MoUs, Static GK (Currencies & Capitals, Important Days, Books & Authors, Awards & Honours, National Parks & Sanctuaries, Important Places, Headquarters), GK Updates

Computer Aptitude (Reasoning)

Puzzles, Seating Arrangement, Number Sequence, Input-Output, Coding-Decoding, Blood Relations, Syllogism, Alphabet Test, Alphanumeric Sequence, Order & Ranking, Causes and Effects, Direction Sense, Word Formation, Inequality, Statement & Assumption, Assertion & Reason, Statement & Conclusion, Statement & Arguments, Statements & Action Courses

Computer

History and Generations of Computers, Introduction to Computer Organization, Computer Hardware and I/O Devices, Computer Memory, Computer Software, Computer Languages, Operating System, MS Word & MS PowerPoint, Computer Network, Internet & Network Security

Screening and Interview

Screening

After the written exam, the bank screens applications to verify the work experience, educational background, and eligibility criteria. Only candidates meeting all criteria move forward to the interview stage.

Interview

The final stage includes a personal interview assessing communication skills, domain knowledge, leadership capabilities, and suitability for the managerial role. It carries a weightage of 100 marks. The final selection is based on the combined score of the written exam and the interview.

PREPARATION STRATEGY

To clear the SBI CBO exam, candidates must combine subject knowledge with strategic preparation. Below is a step-by-step preparation plan:

Create a Study Plan

Dedicate at least 3–4 months of structured preparation. Break down the syllabus and allocate specific time to each section weekly. Give more time to weak areas and descriptive writing.

Strengthen the Basics

Revisit core concepts, especially in Banking Knowledge and General Awareness. Use NCERTs for economy basics and RBI/SEBI websites for regulatory updates.

Stay Updated with Current Affairs

Read newspapers like The Hindu or The Indian Express, and magazines like Pratiyogita Darpan. Focus on financial news, RBI announcements, mergers/acquisitions, and government schemes.

Practice Descriptive Writing

Write essays and letters every alternate day. Follow a formal tone, use data and examples, and review your content for grammar and structure.

Take Mock Tests

Join online test series and simulate real exam conditions. Analyze performance and work on time management, accuracy, and speed.

Prepare for the Interview

Be ready with answers about your previous job roles, achievements, local banking challenges, and why you want to join SBI. Revise banking and economic fundamentals.

RECOMMENDED BOOKS AND RESOURCES

English Language:

- Wren & Martin English Grammar

- Word Power Made Easy by Norman Lewis

- Previous year PO/Clerk papers

Banking Awareness:

- Banking Awareness by Arihant

- RBI’s Financial Stability Reports, RBI circulars

- Economic Times & Business Standard

General Awareness:

- Monthly magazines (Bankers Adda, AffairsCloud PDF)

- Yojana and Kurukshetra for economic schemes

Computer Aptitude:

- Lucent’s Computer Knowledge

- Internet-based tutorials (YouTube, online courses)

Mock Tests & Practice:

- Oliveboard, Adda247, Testbook, PracticeMock

The SBI Circle Based Officer (CBO) examination opens a remarkable career path for experienced bankers aiming for a managerial role in the public sector. With the right balance of knowledge, strategic preparation, and a clear understanding of the exam structure, candidates can significantly enhance their chances of success. Consistency, discipline, and a keen awareness of the banking ecosystem are the keys to cracking the SBI CBO exam and stepping into one of the most stable and respectable positions in the Indian banking sector