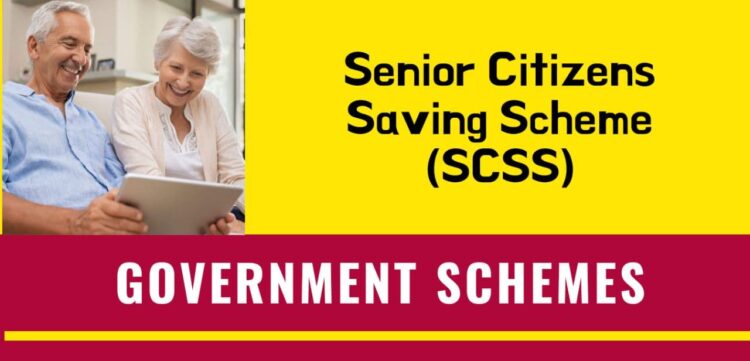

In the year 2004 a government-sponsored savings scheme for senior citizens was launched by the Title Senior Citizen Savings Scheme (SCSS).The main purpose of the scheme is to allow senior citizens to guarantee a regular flow of income.

The scheme offers guaranteed interest payment, which can be received on a quarterly basis. As this scheme is solely a government-run scheme, the interest rate and other conditions have been set keeping in mind the financial needs of retirees.

Eligibility for SCSS Scheme

The eligibility criteria for the citizens who want to avail this scheme is as follows

- Applicant must be a citizen of India. Non-residential Indians (NRIs) are not eligible to avail this scheme. Also, Hindu Undivided Family (HUFs) do not qualify for this scheme.

- Citizens aged 60 years or above are eligible for this scheme as this is a senior citizen savings scheme.

However, there are few exceptions to the age bar

Retirees in the age group of 55-60 years who have opted for Voluntary Retirement Scheme (VRS) or Superannuation are eligible to avail the scheme if they apply for the same within one month of gaining their retirement perks.

- Retired defence personnel can avail this scheme irrespective of their age, provided they fulfil all other conditions.

- By depositing a minimum amount of Rs 1000 this scheme can be availed.

Benefits of Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Savings Scheme (SCSS) offers safety and guarantee of your investment as a government-run scheme. Here’s a look at some other benefits of investing in this scheme:

- It offers reasonable returns on your investment.

- It is extremely easy to open, operate, and transfer SCSS account at any authorized bank or post office in India.

- This scheme offers the flexibility to extend tenure. Applicant can start with a tenure of five years, and after its maturity, they may extend it up to three more years. However, the tenure can be extended only once.

Applicants can calculate the SCSS interest rate easily, by computing the compound interest on deposit amount as per the SCSS interest rate for that quarter. The payment is released annually to the savings account of the account holder.

Limitations of Senior Citizens Savings Schemes

There are a few limitations of Senior Citizen Savings scheme as well being a great option for those above 60 years of age. Here’s a look at some of its limitations below:

- Limited tenure:This scheme is restricted to five years. Only a one-time extension up to three years is possible. So, citizens cannot invest in it beyond eight years.

- Tax deduction:Income tax is deducted on the interest earned. This decreases your overall earnings.

- Cap on investment amount:Citizens can invest a maximum of INR 15 lakh (individually or jointly) in SCSS account. Also, their investment can’t exceed the amount they receive on their retirement.

- Penalty on premature withdrawal:Applicants can also close their SCSS account at any time with minimal penalty charges.

What makes Fixed Deposit a better investment option?

Another good investment option is Fixed Deposit for senior citizens looking for high, stable returns on their investments, Unlike SCSS, investing in a Fixed Deposit can offer higher flexibility in terms of investment amount, tenure and guidelines for premature withdrawal. Here’s a look at factors that make investing in a Fixed Deposit a better option than SCSS:

High returns for senior citizens

Senior Citizen Fixed Deposit from Bajaj Finance offer an attractive interest rate. The interest rate offered is as high as 6.85%, and there is an additional benefit of 0.10% on renewals. No other fixed income investment (including SCSS) offers such a high interest rate.

Flexible tenure

Citizens can choose the tenure as per your needs. Bajaj Finance offers flexible tenure in the range of 12 months to 60 months. Senior citizens can protect their investment against inflation by opting for shorter tenures. Also, you can renew your FD upon maturity of your deposit. There is no limit on the number of renewals.

Periodic interest payouts

Senior citizens can avail periodic interest payouts with Bajaj Finance FD to meet their regular monthly expenses. They can choose monthly, quarterly, or annual payouts.

FD calculator

Cititzens can calculate the maturity amount of their FD investments with online FD calculator. This leaves no room for any confusion or ambiguity.

Easy access

Financiers like Bajaj Finance offers the ease of investing in a Fixed Deposit online from the comfort of your home. For senior citizens looking to invest offline, Bajaj Finance provides the facility of doorstep document pick-up at no additional cost.